By Bernardo Bátiz-Lazo, Leonidas Efthymiou and Sophia Michael

“Underneath most of these new [fintech] launches, including

Apple payments, you find the actual payments

are running on the same rails as they always have.” [1]

Unbounding Prometheus

Since the beginning of the global financial crisis in 2007 and the conundrums of European debt in 2010, the world has witnessed important shifts in domestic and international monetary policies. Often it seems that law, democracy and social wellbeing have been overwhelmed and consumed by the logic of neoclassical economics while the narrative in the media gets immersed in speculation about the nitty-gritty of political intervention. It is as if social variables and international relations have been squeezed through the metrics of supply, demand and fiscal quantification.

In this entry to the Charisma blog we outline plans to use the Greek bailout of 2015 to understand financial phenomena from a sociological perspective. Greece makes up 2% of the Eurozone economy. Yet, with a Grexit half out of Pandora’s golden casket, we shall argue that little Prometheus has shaken the European Union (EU) to its foundations, putting solidarity into question and casting doubt on whether euro worth saving.

Olympus has Fallen

Most people know that the Greek economy is in a dire state: between 2010 and 2015 the Greek GDP fell 25%[2];[3];[4], its deepest recession in record. Not surprisingly Greek youth unemployment is amongst the highest in developed countries as more than 50% of 15 to 24 year-olds are without a job.[5] And the outlook is even more dismal: at the time of writing, Greece is the most indebted country in the EU with government debt expected to peak at 200% of GDP in 2017.[6] Meanwhile over 20% of its population is 65 years or older placing Greece among the countries with the highest rates of ageing population in the EU.[7] At the same time, women retire at 59 and men at 63 years of age. Enormous pressure has built in and questions the viability of the Greek pension system as well as its future stability.

Greece is now at par with the Argentina of the 1990s and Brazil of the 1980s as examples of countries in deep macroeconomic malaise, while its political leaders are defiant of the recipes for austerity of IMF-led financial assistance. Our plan then is to recast these developments as framed by the ever-expanding Sociology of Finance literature. However, we depart from the dominant trend in this literature which deals primarily with high-value payment systems, to focus on the “subterranean and mundane” of retail payments and their links with broader, macroeconomic and macro-political trends.

The Myth of the Digital Hermes

David Wolman’s “The End of Money”[8] is the modern day Pythya that vaticinated a worldwide trend where greater use digital retail payment brought about the dead of banknotes and coins. Evidence of this trend was apparent when considering the vast media attention drawn to figures for UK payments, which in 2015 showed Britain joining Scandinavian countries as realms where cashless payments have overtaken the use of notes and coins.[9]

However, Apollo seems to have met his death in debt stricken countries, where cash has progressed in the exact opposite direction. In Argentina, for instance, the government of Cristina Fernández de Kirchner systematically refused to add new banknote denominations keep up with inflation.[10] As a result, the one to one parity with the US dollar of 1992 saw the $100 pesos note worth little more than ten dollars in 2015. The printing press was literally unable to keep up with demand in spite of working at top capacity and issuing the greatest number of $100 peso notes in the previous 12 years (while lower denomination bills rapidly deteriorated as production was almost entirely made out of the £100 pesos notes). Meanwhile, the Financial Times reported that:

“The number of banknotes in circulation in Greece was €45.2bn at the end of May [2015]: a level last seen in June 2012, the last time fears of a Grexit sparked a bank run. In 2012, the ECB had to fly additional supplies of banknotes to Athens from around the region. The €45.2bn amounts to a little over €4,000 for every Greek.”[11]

As noted in the quote (above) and shown in Figure 1 (below), Greece is country where cash transactions predominate. This helps to explain why during the 2015 bailout crisis Greeks turned to automated teller machines (ATMs) rather than electronic banking. For one, the extended bank holiday effectively closed the door to all international payments (see figure 1).

Figure 1: Becoming a cash-reliant economy[12]

Secondly, as late as 2015 Greece had the lowest rate of regular Internet usage in the EU while it rank 26th out of the 28 EU member states in terms of Internet connectivity[13]. More precisely, the percentage of Greek Internet users (aged 16 to 74 years old) engaging with online banking was 21% and shopping online 40% while the EU average was 57% and 63% respectively for the period between 1st June 2014 and 1st June 2015. Also and according to data from the European Central Bank (ECB), Greece repeatedly ranked at the bottom of the EU member-states list in the use of electronic payments.[14]

(Figure 2: A brief timeline of the three-week banking shut-down)

World media circulated images of lengthy queues in front of ATMs (such as those in Figure 3) as means of capturing the travails of the Greek people during the 2015 bailout talks. These images were meaningful for at least three reasons. First, anecdotes from those attending EGOS 2015 in Athens (which coincided with the crisis) suggested such images were rather alarmist as Greek citizens showed little panic to capital controls. Lines at ATMs were shorter than expected. One would be inclined to believe Don’s Diary over Fleet Street’s overembellisment. Leaving this debate for a better day, our second reason points to the ATM as one of the most perduring images of a material connection with the increasingly digital banking experience. For most consumers in developed nations contact with today’s otherwise-ephemeral financial services take place at the fringes of banking organizations: through ATMs, plastic cards, electronic point of sale terminals, mobiles, tablets and telephone banking.

(Figure 3: Greeks queuing at the ATM while the banking system is shut)[15]

A third reason why these images are significant is because they point an apparent shift in Greeks’ spending mentality since the crisis began in 2009. This shift is reflected in the increase of debit card payments and sharp decline of credit cards. As consumers buying power decreased; banks became far stricter on issuing credit cards and, consumers became more convinced about the safety and convenience of debit cards, especially for small value payments.[16] The number of credit and debit cards in 2014 totalled 12,610,623 (of which 9,845,258 debit and 2,765,365 credit), more than one for each member of the population[17]. Also, indicative of the suffocating economic context is the sharp decline of bank branches, ATMs and POSs terminals as presented in Table 1.

| Automated Teller Machines (ATMs) per 100,00 adults, Greece | ||||||||||||

| 2010 | 2011 | 2012 | 2013 | |||||||||

| 76.82 | 73.07 | 71.19 | 60.31 | |||||||||

| Source: The World Bank[i] | ||||||||||||

| ATMs located Nationwide, Greece | ||||||||||||

| 2009 | 2010 | 2011 | 2012 | |||||||||

| 9,176 | 8,653 | 8,551 | 8,324 | |||||||||

| Source: European Central Bank[ii] | ||||||||||||

| POS Terminals Nationwide, Greece | ||||||||||||

| 2009 | 2010 | 2011 | 2012 | |||||||||

| 426,501 | 412,901 | 361,871 | 321,194 | |||||||||

| Source: European Central Bank[iii] | ||||||||||||

|

Table 1 |

||||||||||||

A fourth and firth additional meanings that emerge images of long queues in front of ATMs (such as those in figure 3) are denotative and connotative. To understand these multiple meanings, we have to separate the photograph in figure 3 into two parts. On the right hand side of image we see ATMs performing services over and above their commercial purpose. ATMs are taking the unusual role of pacifying society. This as ATMs are preventing social unrest and a bank-run on deposits by panicked stricken citizens. Countries hardly ever shut their banking system. Certainly not in modern times. But when they have actually done so, it has been with the sole purpose of protecting the stability of their economic system. At least that has been the argument behind prolonged bank closures in the USA (1933), Argentina (2002) and Cyprus (2013). But none of these has been as lengthy as the one observed in Greece (2015). During the Greek “bank holiday” branches were closed foreign electronic transactions blocked. Greek ATMs were programmed to issue the daily amount of €60 to domestic customers, as a way of securing a stable daily life. At the same time, electronic transactions at electronic point of sale terminals (POSs) enabled the Greek government to monitor the flow of cash (and taxable income).

In the left-hand side of figure 3, we see posters and graffiti that invite people to lifelong resistance and urge an exit from the EU. This is one example among the countless graffiti and posters on Greek ATMs, reminding people of an unforgiving reality: each withdrawal brings their country closer to an unprecedented surrender of sovereignty; and that Europe is on the verge of a strategic dead-end.

In the next section, we will argue how the payment crisis effectively challenged the European dream. Payments in general and retail payments in particular become an arena where unity ambitions and economic reality collide.

A Modern Day Titanomachy

The story of Greece in the European Union (EU) dates to 1975, immediately after the military dictatorship was removed from government and democracy restored. At this point in time, the peak of the cold war, Greece became a symbol of consolidated democracy and stability in southern Europe. Greece was to be a model of transition to democracy and economic prosperity that, allegedly, was followed by troubled nations, often under authoritarian regimes such as Spain, Portugal and countries of the former Soviet Bloc. Indeed, as many of these formerly troubled nations secured European integration, the Greek democracy-led model was (presumably) chiefly responsible for raising the number of EU member states from 10 in 1981 to 28 in 2013.[18]

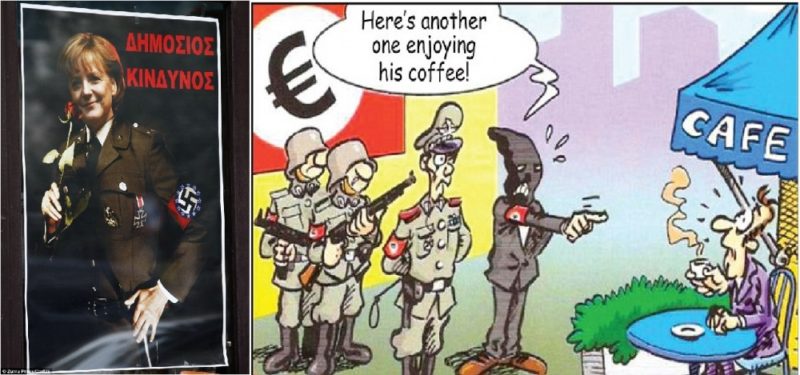

Yet and in an apparent paradox, the Greek crisis became the home to a host of offending cartoons against a leader of another European nation. Growing out of the ruins of world war two and the tension of cold war, it is indeed questionable how ‘unity’ has traversed from the images showing the fall of the Berlin wall in 1989 to recent images portraying the German Chancellor, Angela Merkel, as Adolf Hitler in France, Britain, Spain, Cyprus, Greece, Poland, Italy, and Portugal[19] (Figure 4).

Figure 4: German Chancellor, Angela Merkel, depicted in Nazi Uniform and Germans as Nazis[20]

During the last 60 years, the project of European integration has gone through a series of stress tests. The Greek events, nevertheless, undermine the very philosophy of the European model, which suggests that the EU is a safe haven for stability and economic prosperity. And while the shadow economy, barter and unrecorded transactions rise in Greece at the expense of the formal, tax-paying economy, it seems to us that a monetary union without a fiscal and political integration has shown the limits of and profound implications for the future of the European project.

Apocalipsis Now

In summary, the case of Greece during its third bailout offers substantial material for the Sociology of Finance with to engage retail payments and the transition to a cashless economy. We are in the process of documenting these events and will welcome any comments and suggestions. We base our work on media reports (in English and Greek) and statistics profiling the Greek market’s retail payments and digital landscape. As a result, we aim to contribute to the Sociology of Finance by providing evidence that links micro elements of retail payment systems with macro issues of political stability and the future of the European Union.

Notes

[1] Armstrong, Stephen (2015) “The Future of Money”, Raconteur (May 31, 2015) http://raconteur.net/technology/digital-money-is-on-the-rise-but-cash-is-kicking

[2] Phillips, M. (30-06-2015) ‘The Complete History of the Greek debt drama in Charts’. In Quartz. Online at: http://qz.com/440058/the-complete-history-of-the-greek-debt-drama-in-charts/, accessed 02-07-2015.

[3] Galbraith, J. (16/06/2015 ‘The IMF’s “Tough Choices” on Greece’. In the ‘Project Syndicate’. Online at: http://www.project-syndicate.org/commentary/imf-greece-debt-restructuring-by-james-k-galbraith-2015-06, accessed 20-06-2015.

[4] BBC (10/07/2015) ‘The Greek debt crisis story in numbers’. Online: http://www.bbc.com/news/world-europe-33407742, accessed 20-07-2015.

[5] The Word Bank (2015) ‘Unemployment, Youth Total (% of total labour force ages 15-24). Online at: http://data.worldbank.org/indicator/SL.UEM.1524.ZS?order=wbapi_data_value_2013+wbapi_data_value+wbapi_data_value-last&sort=desc, accessed 20-07-2015.

[6] International Monetary Fund, IMF (14/07/2015) ‘IMF Country Report No, 15.186: Greece’. Online at: http://www.imf.org/external/pubs/ft/scr/2015/cr15186.pdf, accessed 15-07-2015.

[7] Index Mundi (2015)’Greece Demographics Profile 2015’. Online at: http://www.indexmundi.com/greece/demographics_profile.html , (accessed, 03/07/2015). Also, an accurate sources is the ‘The 2015 Ageing Report’ by the European Commission. Online at: http://ec.europa.eu/economy_finance/publications/european_economy/2014/pdf/ee8_en.pdf, (accessed, 03/07/2015).

[8] David Wolman (2013) “The End of Money: Counterfeiters, Preachers, Techies, Dreamers–and the Coming Cashless Society” (Boston, MA: Da Capo Press) http://www.amazon.com/The-End-Money-Counterfeiters-Dreamers/dp/0306821478

[9] Armstrong, Stephen (2015) “The Future of Money”, Raconteur (May 31, 2015) http://raconteur.net/technology/digital-money-is-on-the-rise-but-cash-is-kicking

[10] http://www.lanacion.com.ar/1819837-la-emision-de-billetes-de-100-es-record-por-la-inflacion (August 17, 2015).

[11] Jones, Claire and Hope, Kerin (2015) “Fears of financial stability keep demand for banknotes strong“. Financial Times (August 17, 2015) http://www.ft.com/cms/s/2/d926399c-39f5-11e5-bbd1-b37bc06f590c.html#ixzz3j5lgHUYo (Accessed 17-08-2015).

[12] The long periods of uncertainty in Greece leaded to depositors removing considerable amounts of money. According to the European Central Bank, in the first quarter of 2015 alone, depositors withdrew 22.5 billion. European Central Bank (26/06/2015) ‘Statistical Data Warehouse: Greece’. Online at: http://sdw.ecb.europa.eu/reports.do?node=1000003177, accessed 01-07-2015.

[13] European Commission (2015) ‘Digital Agenda for Europe: A Europe 2020 Initiative’. Online at: https://ec.europa.eu/digital-agenda/en/scoreboard/greece. Accessed 05/07/2015.

[14] Anampa (2015) ‘Use of Plastic money has favourable growth prospects in Greece’. Online at: http://www.amna.gr/english/articleview.php?id=9741, (accessed 03/07/2015).

[15] Brinded L. (03/07/2015) ‘Graffiti of one particular word is smothering Greece’. In Business Insider UK. Online at: http://uk.businessinsider.com/greece-referendum-no-campaigners-graffiti-oxi-sway-voters-2015-7, accessed 03-07-2015).

[16] Euromonitor International, Financial Cards and Payments in Greece, Executive Summary. (2014). Online at: http://www.euromonitor.com/financial-cards-and-payments-in-greece/report, accessed 03-08-2015

[17] This is without calculating pre-paid cards and cards issued by cooperative banks.

[18] Rankin, J. (03/07/2015) ‘Greece in Europe: a short history’. In The Guardian. Online at: http://www.theguardian.com/world/2015/jul/03/greece-in-europe-a-short-history, accessed 7-07-2015.

[19] Blome et al (23/03/2015) ‘The Fourth Reich: What some Europeans look when they see at Germany’. In SPEIGEL Online International. Online at: http://www.spiegel.de/international/germany/german-power-in-the-age-of-the-euro-crisis-a-1024714.html, accessed 12-07-2015.

[20] Daily Mail (15/02/2015) ‘Greeks brand Germans Nazis for driving through painful cuts and taking control of their economy’. Online at: http://www.dailymail.co.uk/news/article-2101614/Greece-debt-crisis-Greeks-brand-Germans-Nazis-taking-control-economy.html, accessed 12-05-2015.